City of Scottsdale issued the following announcement on May 29

This “Truth in Taxation” hearing notice regarding the City of Scottsdale primary property tax levy is being published as required by Arizona state law.

A public hearing on Scottsdale’s proposed property tax levy will occur before final budget adoption, scheduled at 5 p.m. Tuesday, June 16, 2020. The meeting may be held electronically through Cox Cable Channel 11 and streamed online at ScottsdaleAZ.gov (search “live stream”), at Scottsdale City Hall, 3939 N. Drinkwater Blvd., or as stated in the meeting agenda available at ScottsdaleAZ.gov (search “agendas”).

The City of Scottsdale will increase its proposed primary property tax levy $1,561,848 (exclusive of new construction). The increase is due to tort liability claim payments made during calendar year 2019. The primary property tax rate is increasing from $0.5198 per $100 of assessed value to $0.5273 in Fiscal Year 2020/21.

The city’s proposed secondary property tax levy will increase $0.4 million due to increased debt service payments. However, due to increased property values, the Fiscal Year 2020/21 secondary tax rate will decrease by $0.0171 from $0.5214 to $0.5043 per $100 of assessed valuation.

In Fiscal Year 2020/21, citizen tax bills will reflect an estimated combined property tax rate of $1.0316, which is $0.0096 less than the Fiscal Year 2019/20 combined rate of $1.0412.

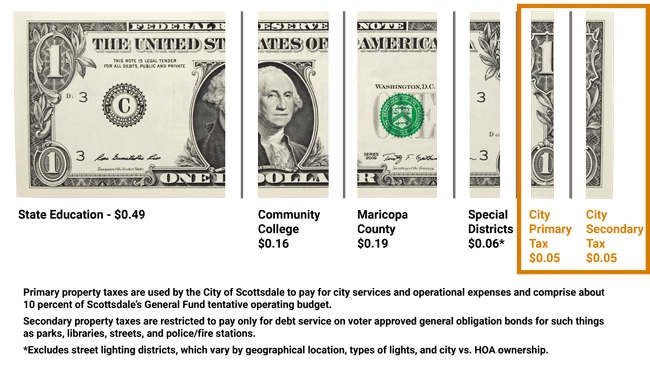

Where Do Your Property Taxes go in Scottsdale?

FY 2020/21

About 10 cents of every dollar in property taxes paid by Scottsdale property owners goes to the city, the remaining 90 cents goes to public schools, Maricopa County, community colleges and various special taxing districts. And of the 10 cents of every dollar paid by Scottsdale property owners, half (5 cents) goes to support voter approved bond programs.

The amount of property tax paid is based on two factors: the tax levy set by the city and the assessed value of the property (as determined by the county).

The City Treasurer’s Office at 480-312-2427 can answer questions regarding the city property tax levy or other budget issues.

Truth in Taxation Hearing: Notice of Tax Increase

In compliance with section 42-17107, Arizona Revised Statutes, the City of Scottsdale is notifying its property taxpayers of Scottsdale’s intention to raise its primary property taxes over last year’s level. Scottsdale is proposing an increase in primary property taxes of $1,561,848 or 4.75 percent.

For example, the proposed tax increase will cause Scottsdale’s primary property taxes on a $100,000 home to be $52.73 (total proposed taxes including the tax increase). Without the proposed tax increase, the total taxes that would be owed on a $100,000 home would have been $50.34.

This proposed increase is exclusive of increased primary property taxes received from new construction. The increase is also exclusive of any changes that may occur from property tax levies for voter approved bonded indebtedness or budget and tax overrides.

All interested citizens are invited to attend the public hearing on the tax increase that is scheduled to be held on Tuesday, June 16, 2020, at 5:00 p.m., which meeting may be held electronically through Cox Cable Channel 11 and streamed online at ScottsdaleAZ.gov (search “live stream”), at Scottsdale City Hall, 3939 N. Drinkwater Blvd., or as stated in the meeting agenda available at ScottsdaleAZ.gov (search “agendas”).

Original source can be found here.

Source: City of Scottsdale

.jpg)

Alerts Sign-up

Alerts Sign-up